Article corresponding to Tuesday December 9, 2008

Article corresponding to Tuesday December 9, 2008The high court's opinion confirms that Judge Maria Isabel Reyes had jurisdiction to adjudicate the case that faces the transnational and Rodolfo Villar mineral rights by 8600 hectares.

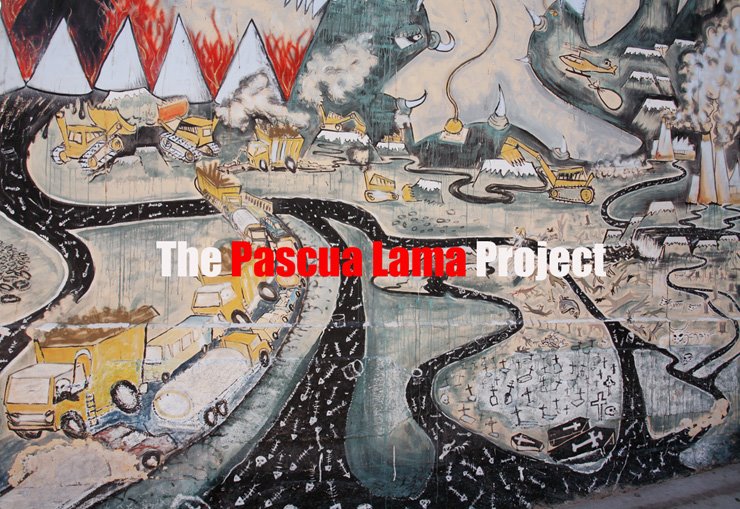

SANTIAGO, Tuesday 9. A complicated coup received the Nevada Mining Company, a subsidiary of Barrick Gold in Chile, for the implementation of the Pascua Lama project in the Huasco Valley, then to the plenary of the Supreme Court ruled last Friday November 28 in a case linked to the emblematic the engineer who faces trial in mines Rodolfo Villar Garcia, with the Canadian company's capital.

This is the process that weighed on the judge's 14 Civil Court of Santiago, María Isabel Reyes, and First Officer of the same body, Ulises Eagle Bar. Identified as the highest court, the judge shall apply only the disciplinary sanction of censure in writing.

In the same ruling, it states that Reyes had jurisdiction to give the opinion of first instance in 2006, which declared the nullity of the transaction whereby in 1996, Barrick Gold bought the mining rights to 8600 hectares located on Villar in the entrance area to the mega project and the gold that would have paid only $ 10,000, which was then considered laughable by the court.

"Removing the 7th considering the term" lacking - hence - of competition and also taking that Ms Mary Kokisch Isabel Reyes gave ruling in the case Rol No. 1912-01, without which it would be in condition to do so was confirmed in appeal , The resolution of June 23 this year, writing 936 pages, "says the Supreme Court ruling.

A source linked to the process, explained that with this ruling the trial which pits Villar with transnational foja zero again and have to see the faces again in the 14th Civil Court of Santiago.

"The Court of Appeals (second instance) had ruled that Judge Reyes had failed to lack of competition but precisely to eliminate that the Supreme Court, automatically suggests that it had jurisdiction and that therefore there is nothing questionable at fault as such, "he explains.

In that regard, said the same source, 14 Civil Court of Santiago should return to the first ruling in favor of Villar that nullified the contract with the Nevada Mining Company.

In the case of Ulysses Eagle meanwhile, the plenary of the Supreme Court applied tough sanctions since found that hindered the process at first instance by not carrying out two acts of shape.

"Run the merit of the background and considering that the charges against Officer First of 14 Civil Court of Santiago gift Ulises Eagle Bar have been accredited reliably, it is not sufficient claims or defenses put forward by him to call, and that the facts are an entity or gravity as to warrant the implementation of a disciplinary measure, the process of motion in the exercise of the powers that are vested this court under Article 540 of the Organic Code of Courts, becomes void dismissal decreed by the Court of Appeals of Santiago, "the ruling said.

"In its place, continuing libel applies to gift-Ulises Eagle Bar, First Officer of 14 Civil Court of Santiago, the disciplinary suspension of duties for a month, with half pay to enjoy."

With this, the high court held that the charges were fully accredited to it previously made to Eagle and that he had left without effect the Court of Appeals.

Ultimately, the Supreme Court credited the First Officer had not signed the CITES to hear verdict and had not notified the resolution in the first instance ruling by Judge Reyes, a situation that ultimately led to the Court of Appeals ruled against and raise the case to the Supreme Court.

In addition, the high court ordered the Public Prosecutor to send background, because in the course of investigating a complaint was made against the Eagles, so their punishment can be much stronger.

"Notwithstanding the foregoing resolved and considering the statements made in the process on the possible commission of an illegal criminal in the gestation of the wording of the verdict in the case Rol No. 1912-2001, please copy of this background to the ministry Public awareness and research for its relevance, "the ruling said. As of press time, Eagle was not yet notified of the verdict. Barrick Gold meanwhile, refused to refer to the subject.